Is Ethereum Now A Contrarian Trade?

Pour one out for ETH. Nobody likes it anymore. Opportunity to go against the crowd? We'll explore.

It’s been a few months since I’ve updated my views on Ethereum. Back in April, I wrote “The Ethereum Conundrum” and noted the declining trend in the ETH to BTC ratio.

At that time, the ratio was 0.05. Since then, we’ve seen that number fall by nearly 20% as it currently hovers just above 0.04:

Not a good look for Ether fans. In May, the weakness in ETH became even more apparent as monthly fees started falling dramatically and token issuance flipped back to inflationary.

I mentioned how poorly the price of ETH had been lagging other cryptos like Bitcoin and Solana and specifically mentioned the deterioration of ETH’s fundamental setup following the Dencun upgrade:

However, I think it could be more accurate to say ETH is struggling because the economics of the chain just dramatically changed.

Then, hilariously a week later, we learned that spot ETH ETFs in the United States were likely to come to fruition and the price of ETH rallied 20% in a single day.

Despite my excitement with the news, I posited fading the rip might be the best course of action at that time:

Even when considering all of the apparent “bad news” that has already been priced in, I don’t know that we can argue ETH is a cheap coin at $3,800. Frankly, I would actually argue this rip could be a nice opportunity to rebalance crypto portfolios if one believes Ethereum’s spot ETF applications will actually gain approval in the United States this week. Especially considering the deteriorating economics of the primary chain that I highlighted last week.

As fate would have it, that turned out to be a stellar call:

At $2,350, Ethereum is down about 40% from the late-May spike. To be fair, Bitcoin is down by 30% over that same time frame. But there’s no question Ethereum has been struggling. Sentiment in the market is terrible. Even crypto people are growing tired of Ethereum’s relative underperformance. Is this is a classic contrarian setup or are Ethereum’s issues too large to ignore?

Let’s dive in…

Fees and L2s

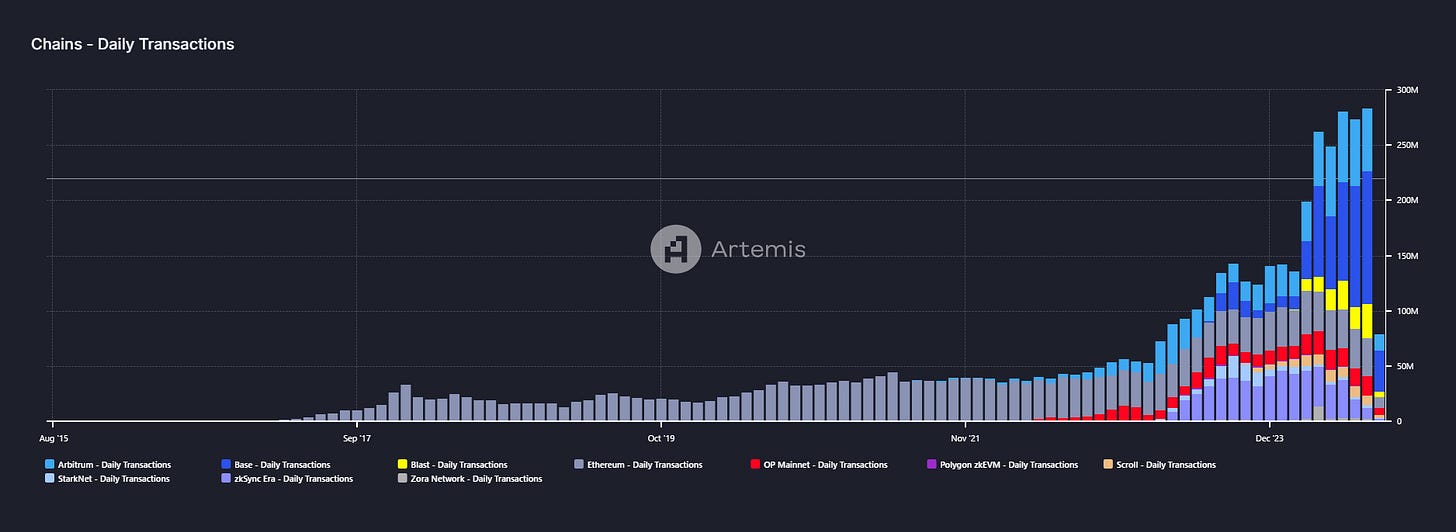

In the month of August, the Ethereum blockchain generated $62.8 million in fees. This is a 60% year over year decline in Ethereum fees during the month of August and a 90% decline from the 2024 high of $607 million in May. The argument has been, and I’ve echoed this, that fee migration from mainnet to L2s isn’t necessarily a bad thing so long as the broader ecosystem scales exponentially and returns that value back to mainnet over time. Do ETH bulls want a large piece of a small pie or a smaller piece of an enormous pie?

Thus, scaling via L2 theoretically has some validity provided the math works. The problem is, in practice, the value extraction from the growing ecosystem isn’t filtering back to ETH and we can clearly see this to be true over the last year:

It’s important to note the scaling factor here and how it has changed over time. At 12.15, this chart is essentially telling us that the transactions per second in the ETH ecosystem have increased by over 12x in the last 365 days due to the throughput improvements on the secondary chains. But look what happens when you shorten the window:

Scaling factors:

30 Day - 30.53x

90 Day - 25.28x

180 Day - 18.14x

365 Day - 12.15x

The scaling multiplier has been improving quite quickly since Dencun and it hasn’t mattered. Despite the growth in usage, network fees have collapsed and the price of ETH is still sinking.

Valuation

When ETH spiked up to $3,800 in May, I noted the circulating price to fee ratio had ballooned to over 300x fees. For Ethereum, this was well ahead of the four year trend and even nearing historical highs going back to 2020. And yet, even with the 40% retracement in the price of ETH since that article, network fees have fallen so badly that the circulating P/F ratio is now considerably higher than it was in May:

Yesterday, the coin’s circulating P/F ratio was 567x fees. The fact that we’re seeing 4 year high P/F valuation multiples for ETH while the coin price is going down is a really telling signal, in my view, and not a good one. This is screaming the economic model for Ethereum has been significantly damaged by the Dencun upgrade earlier this year.

Network Users

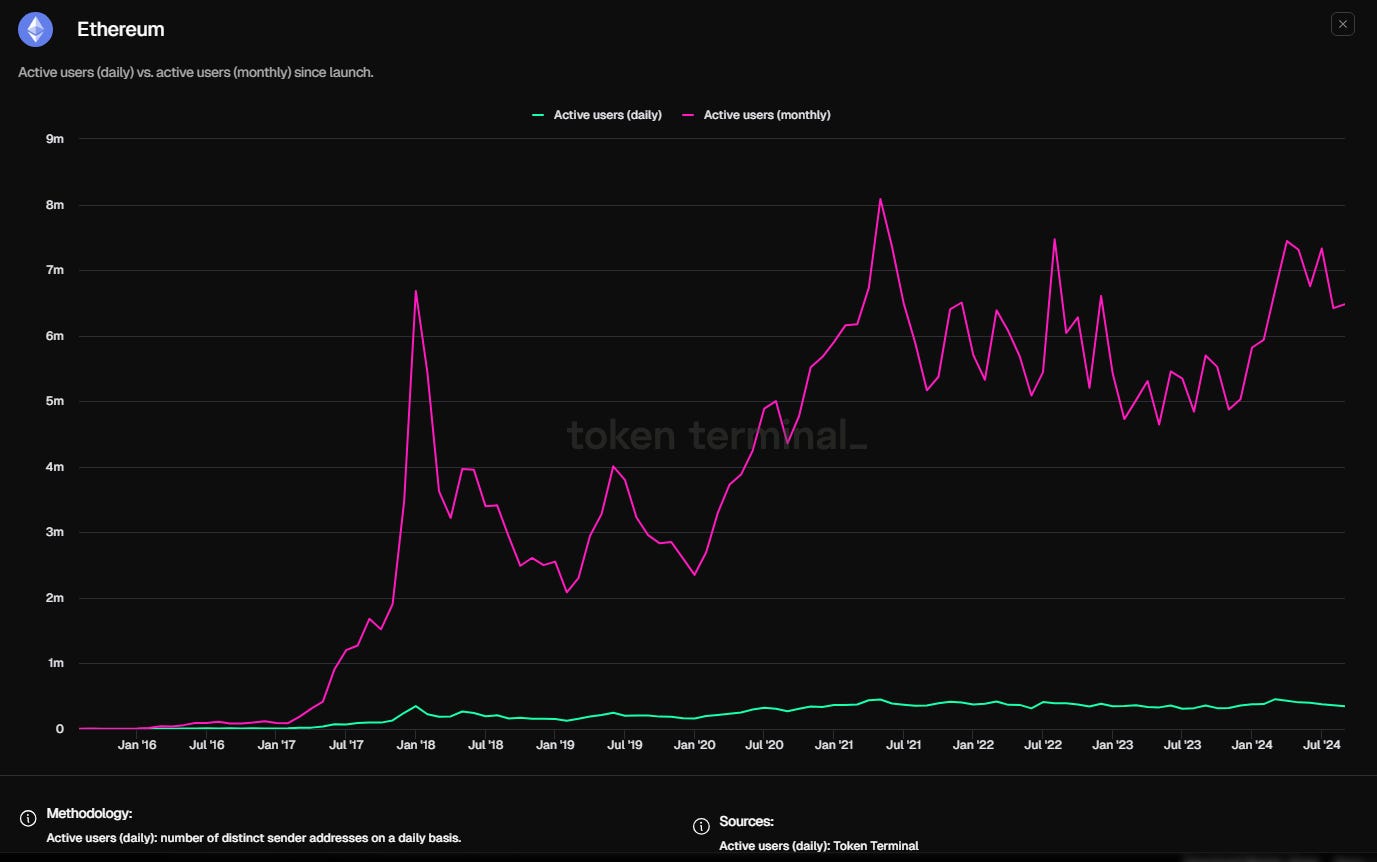

If there is any positive takeaway that I can can provide, it’s that monthly active users of Ethereum are still holding up quite well. A multitude of other L1 chains have experienced collapsing MAUs this year (Avalanche, Cosmos, Cardano, Flow) but Ethereum is not among them. That said, there are now five smart contract L1 chains that have higher MAU figures currently:

Solana is clearly in the lead here, though as I noted last month, most of this usage is bot trading - thus, it’s closer to nonsense than real activity.

But I’m getting away from the larger point. Ethereum is losing favor with the market and for good reason. The L2s that are scaling the chain are collecting fees but not paying a large enough portion of that revenue back to the main network. Thus, L2s have undoubtedly become parasitic to ETH as a gas token given the current state of the network.

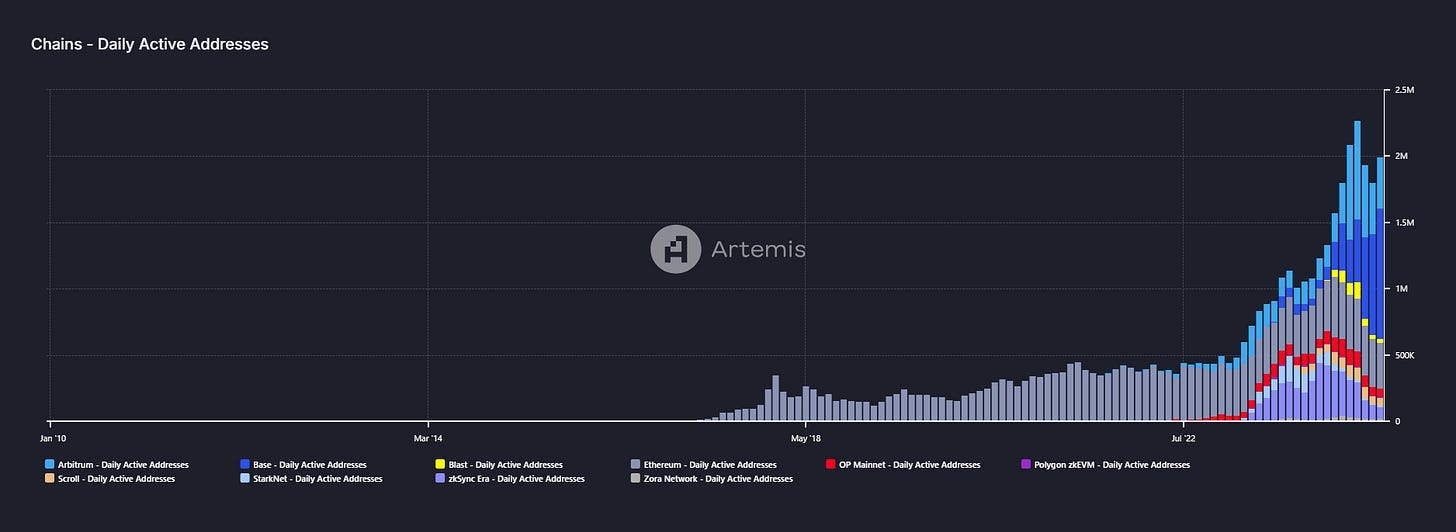

Look at the ecosystem DAAs in a stacked chart format:

The chart above is showing combined daily active addresses on Ethereum, Base, Arbitrum, Blast, Optimism, Polygon zkEVM, Scroll, StarkNet, zkSync Era, and Zora Network — all ETH L2s. The DAA trend is up. The same is true for transactions:

And yet something doesn’t seem to be working. None of this is actually helping ETH. In fact, it’s arguably hurting ETH because the organic bid for gas on mainnet is going away even as ecosystem usage expands.

When I launched BlockChain Reaction through Seeking Alpha 2.5 years ago I felt that digital assets and public blockchain infrastructure was the next big boom in capital markets. My view at the time was that what is currently known as “crypto” would be seen more as a second “dot com” period where fortunes would be made from finding the Amazons AMZN 0.00%↑ in the space even though most assets would fall to their intrinsic value of zero. I actually still think much of that is true, but I’m growing increasingly unconvinced that we’ll see new all time highs in many of these assets, even top assets like ETH. And perhaps that shouldn’t be a surprise given the dot com comparison.

It took Cisco CSCO 0.00%↑ many years to get back to 1999 share price levels. It still hasn’t even sniffed its all time high from March 2000 more than 24 years later. I’ve obviously made the case that I think NVIDIA NVDA 0.00%↑ will endure a similar fate. But that’s just my personal view. In each instance, we’re talking about assets that power a larger movement. For Cisco, it’s internet hardware. For NVIDIA, it’s AI chips. For Ethereum, it’s a parallel internet-based economy… or perhaps, an internet bank.

What’s the price we’re paying for that idea today?

Basically the same thing we’re paying for Bank of America BAC 0.00%↑ - which is arguably already what many of us probably want Ethereum to be. If there’s a mispricing here, I’m not sure it’s BofA. I don’t know that ETH should be worth the same as Netflix NFLX 0.00%↑- certainly not when network fees are collapsing, the asset is once again inflationary, and real users are generally measured in the single-digit millions each month.

Final Takeaways

So I suspect this is what the smart money is seeing and this is why ETH is performing so badly. All of this may be why capital is flowing out of ETH ETFs rather than in them. I’d love to be able to say I see a contrarian opportunity here but the truth is, I don’t. That could certainly change in the future. I’m by no means throwing in the towel altogether on Ethereum or saying that I think it’s not still one of the better bets in the blockchain space; I still do believe that. But there are real problems with the structure of the network at the moment and I don’t see a clear catalyst that turns those issues around.

It isn’t all doom and gloom today though…

One good thing is seasonality for Ethereum is shifting to ‘very good’ in a couple weeks. October is historically one of the better months for ETH and I suspect that many in the market are looking for strong closes to the year for BTC, ETH, and alt coins in general. That remains to be seen. But if you agree with my current read on ETH fundamentally and want a better exit price, you may get it in a few weeks. At of the end of the day, these things still serve a marvelous purpose as speculative instruments. Perhaps there’s a nihilism there but it is indeed the way I currently view most of this industry.

As always, I’m happy to hear your thoughts in the comments or in the chat - so please don’t be shy if you feel I’m missing something important.

Disclosure: I’m not an investment advisor. I still personally hold ETH - though a little bit less than I did 12 months ago.

Appreciate the way you broke this down!