An Honest Assessment of The Orange Coin

With both assets making new all time highs this year, the Bitcoin vs Gold debate is starting to get some mainstream play again. I still prefer holding both. But I'm liking one a lot more.

It probably seems like I’ve been picking on Bitcoin ($BTC-USD) a lot lately. As someone who has significant financial exposure to the asset, this may seem counterintuitive. The reality is there are plenty of people on the internet who are capable of telling you all the reasons BTC will go to $1 million. Additionally, there are plenty of people on the internet who are capable of telling you all the reasons BTC will be a long term goose egg. There are not that many people who are capable of offering a nuanced take that highlights strengths, weaknesses, opportunities, and threats.

Bitcoin’s SWOT Analysis

Let’s do a quick and easy SWOT summary on Bitcoin, shall we?

Strengths: permissionless, decentralized, fixed supply

Weaknesses: scalability, incentive misalignment, privacy

Opportunities: fiat destruction, non-custodial interactions, Gold

Threats: alternative coins and networks, criminalization, Gold

Yes, Gold is both a threat and an opportunity and I’ll get into why later. Before going much further, if you’re new here and want a more detailed explanation of how I personally view Bitcoin as a philosophical idea, you can read that here:

The reason I have steadfastly held firm on “bullish Bitcoin” despite its faults is the same reason I’ve steadfastly held firm on bullish Gold despite some of its faults; neither are state-issued or managed. Though you can lend against them and create as many IOUs as you soul desires, at the end of the day Jerome Powell can’t push a button and create more of either.

Bitcoin is not going to be everything to everybody. And that’s totally fine. What we have to do as individual investors/traders is determine whether we believe any single asset’s strengths outweigh the weaknesses. From there, we have to decide what the best way to express that idea is.

Bitcoin Strengths

Bitcoin is without question the most decentralized digital asset in the entire cryptocurrency market by almost any metric one chooses. At 89%, BTC is almost entirely held by “retail” investors/traders:

Retail buyers hold over 17.5 million of the 19.7 million BTC that is currently in circulation. Distributed supply of coins typically helps to prevent whales or large holders from manipulating the market. Decentralization of holders is just one part, one of the biggest strengths for Bitcoin is the decentralized system of compute power securing the ledger where BTC lives:

As the price of Bitcoin increases, there is potentially more competition for new coin issuance through the block reward. We touched on that earlier this week:

Computers, or “miners,” are rewarded with the new coins when they validate transactions on the ledger. Today, there are 6.25 new BTC issued through each new block. Next week, that figure will be down to just 3.125.

Regardless of how many coins are issued through new blocks, the competition for the block reward subsidy means there is no single entity that controls the supply of BTC. It can not be controlled or manipulated by central bankers. Anyone (with the capital and technical knowhow) can plug in machines and start mining. It’s entirely permissionless. This is the most significant selling point in my personal opinion - and coupled with the fixed supply - the lack of a central issuer is likely the largest reason Bitcoin has survived the narrative pivot from peer-to-peer currency.

Bitcoin Weaknesses

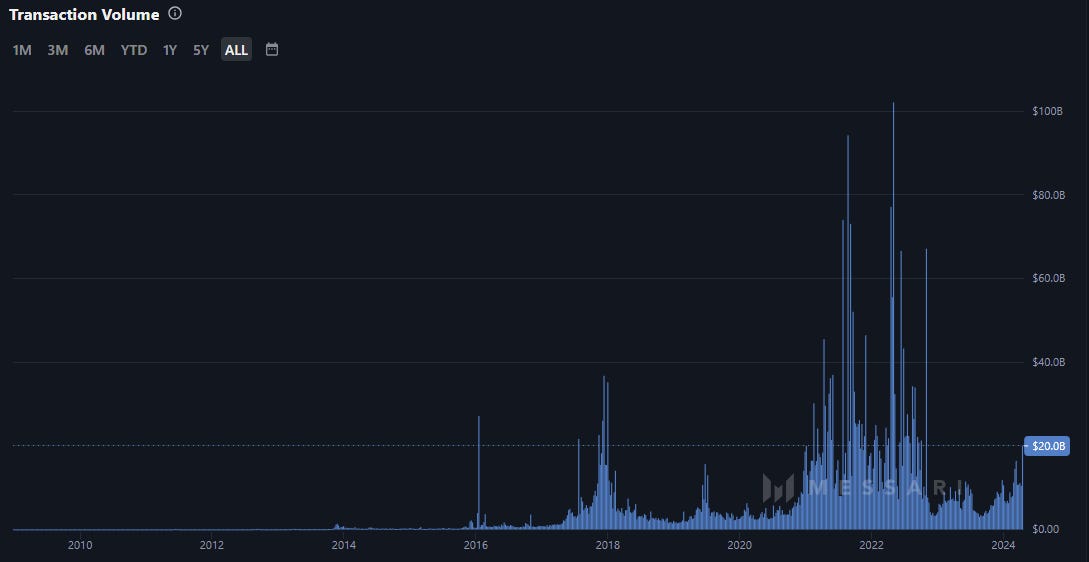

Let’s start with acceptance that, as currently constructed, Bitcoin is not the network for the masses that it was originally designed to be by “Satoshi Nakamoto” following the financial crisis. For some, this is perfectly fine. For others, much less so. But just because you or I may not transact in Bitcoin regularly, it doesn’t mean there aren’t people who are willing to do so. Transaction volume in recent weeks has indeed started to trend higher:

Heading into this week, the $16.4 billion in transaction volume during the week of March 11th was the largest week of adjusted transaction volume for Bitcoin since the week FTX blew up. We’re currently well beyond that level. Even still, at $20 billion already this week, we’re still below the transaction volume highs from the 2017 bull run and we aren’t even sniffing the highs from the last cycle.

In my view, this illustrates just how little the base layer is being utilized compared to what would be expected for an asset/network that was being meaningfully adopted. No problem as long as scaling chains are being utilized right? Ain’t happening, at least not the way it’s “supposed to be” happening:

Bitcoin’s Lightning network has long been touted as the fix to addressing Bitcoin’s scalability problem. I’ll admit, I’ve seen this as a solid solution in the past as well. I no longer believe that to be the case for two critical reasons:

The user experience sucks. I’ve tried it personally, it’s ugly. Lightning takes engaging with public blockchains - already cumbersome to begin with - and takes complexity to another level with channels. It’s not a surprise channels are down nearly 40% from the peak two years ago.

High base layer fees essentially break the network’s viability because paying to batch nearly free transactions is a donation not a business. Base layer fees also disincentivize opening new channels due to the on-chain cost at the user level.

In my view, there’s a reason Lightning Network spending capacity measured in BTC started dropping shortly after the transaction fees spiked last May. It’s the base layer fees and the negative capacity trend that has continued as total fees have risen over the last 12 months or so:

Unfortunately, Bitcoin’s fees are a necessary evil. If we think of Bitcoin’s hash rate as representing “transaction validators” rather than “coin miners” we begin to see the long term necessity of Bitcoin transaction fees. Without stable fees from usage, there is no longer an incentive to secure the network when all coins have been issued via the block reward.

Beyond fees, Bitcoin has additional flaws; it is absolutely atrocious at privacy. There are measures that can be taken to anonymize BTC balances but those require additional risks that aren’t required from privacy-focused blockchains like Monero ($XMR-USD) or Zcash ($ZEC-USD).

The Opportunity

One major advantage BTC has over real world assets or commodities is a hard capped supply limit. We can mine more metal. We can build more houses. We can dilute stonks. We can drill for more oil and plant more crops. We can certainly create more digital currencies or fork Bitcoin again and again, but if the market doesn’t accept those alternatives, BTC will likely remain the king of the cryptocurrency market.

On the Bitcoin ledger, there will only ever be 21 million. If these coins are denominated in a currency that is dying, there is no reason nominal price can’t continue much higher:

We currently have $34.6 trillion in national debt. Interest expense on debt surpassed $1 trillion in Q4-23. $1 trillion on interest alone… in a single quarter. We’re not headed off the cliff, we’re already over it and running on air. Since Bitcoin is an entirely different system all together, it has an opportunity both as a hedge on fiscal policy and a hedge on currency debasement. For many, Gold ($XAU-USD) already serves as that hedge:

At a $2,365 per ounce, the 7.5 billion Gold ounces above ground have a combined market capitalization of $18.5 trillion. This means Gold’s market cap has added $2.7 trillion in valuation since February. Bitcoin’s market cap today is $1.2 trillion. Gold has added more than two whole Bitcoin caps in just two months. While I’d argue Gold is actually proving it’s the desired system hedge in real time even though the percentage gains don’t necessarily show it, Bitcoiners would likely argue Gold’s valuation is an opportunity for Bitcoin to ultimately grow share of the “system hedge” trade. Younger people are possibly more likely to embrace Bitcoin than metal.

The beauty of both assets, and this is the reason that I still advocate holding both to this day, is that neither can be printed by central bankers. Additionally, neither require custodial support to hold or use; though this reality is becoming increasingly out of reach for many people (for both assets).

Threats

Gold is just as much a threat to Bitcoin as it is an opportunity. The critical advantage that something like Gold (or even Silver ($XAG-USD) has over Bitcoin is that it’s actually a natural element with real utility. Gold is used in electronics and in jewelry fabrication. Gold doesn’t require electricity to change hands. During hypothetical in-person barter, I can trade Gold for real assets at essentially no cost and without third party involvement - not so for Bitcoin which requires the same validation system whether I’m 2,000 miles away from my trade partner or sitting in the same room with them.

But across borders, BTC’s mobility is without question better than physical Gold. I can send BTC halfway around the world and enjoy settlement within minutes. Sending physical Gold requires shipping, insurance, and takes much longer. Walking across borders with metal isn’t easy either; certainly not at any meaningful size. However, a Bitcoin holder can cross over borders with nothing more than a memorized seed phrase and gain access to the ledger on the other side.

That said, this cross-border settlement advantage that Bitcoin has over Gold, Silver, and all fiat currencies is what introduces so many other additional blockchain-native threats to Bitcoin; BTC isn’t the only currency that is capable of this:

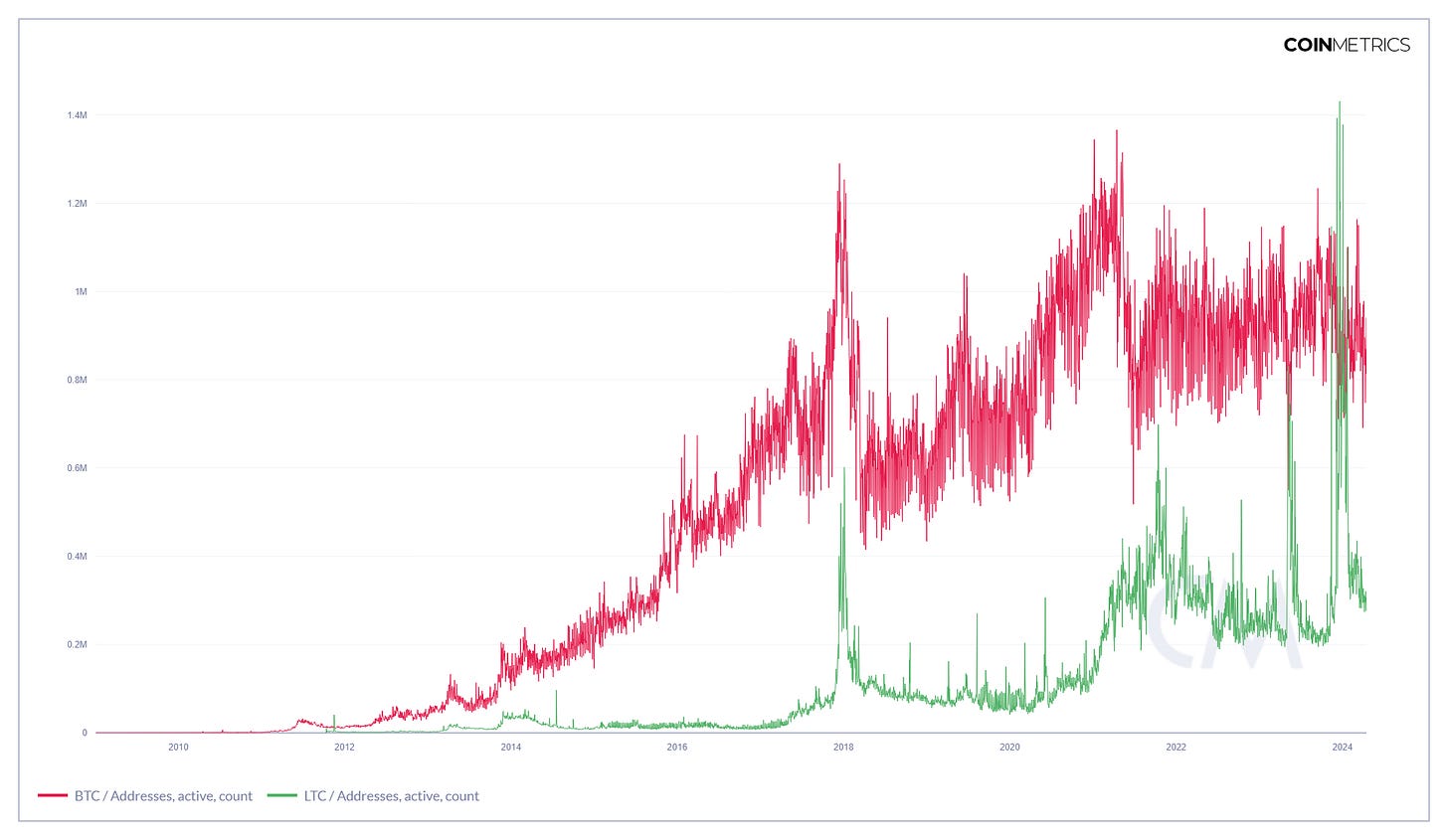

I know, I’ve made this point numerous times but it needs to be repeated; when Bitcoin transaction fees spiked late last year, people who actually use these blockchain networks to transfer value turned to Litecoin ($LTC-USD). At several points in December and January, there were actually more active users of Litecoin than of Bitcoin during various 24 hour periods.

Outlier? Maybe, but remember… Bitcoin’s future is going to require user fees to incentivize transaction validation. And Litecoin’s DAU growth trend looks to have more long term upside than that of Bitcoin at this point. Bitcoin has yet to make a new ATH in active users this cycle and even Bitcoin’s 2021 active user high was only marginally higher than its 2017 single day active user high. Litecoin has made three distinctly new DAU peak events since 2017 - admittedly from a smaller starting point than Bitcoin.

My biggest knock against Litecoin is it’s swimming against the sentiment current - the market hates it. Probably because its actually useful and isn’t reliant upon holders never selling it to have value. But there are countless other currencies that address Bitcoin’s short comings either as scalable network or one that offers privacy without mixers.

Closing Thoughts

The key to Bitcoin’s future is fees. Miners need more of them. Users need less of them. For the ‘filthy masses’ to want to use Bitcoin as a currency/payment network, it has to be cheaper than Visa V 0.00%↑, Square SQ 0.00%↑, and PayPal PYPL 0.00%↑. And again, unless BTC core developers flip and decide to raise the block size limit to keep up with on-chain address growth, scalability seems like a long shot. And this is if people even want to escape the dollar system at all. With inflation at generational highs, hedging USD probably shouldn’t be such a tough sell. But BTC’s price volatility is not exactly a shining beacon of stability.

For now, it seems as though spot ETFs are the easiest way to get exposure to Bitcoin - and in a tax advantaged way if one buys these funds in a Roth. Strangely, many Bitcoiners (myself included) who have preached the merits of self-custody are now okay with custodial instruments. Is it because it helps pump our bags? Maybe. But it’s also the fee component. It’s not a real secret what has driven Grayscale’s 50% BTC puke since ETF conversion in mid-January. I’m floored that BlackRock BLK 0.00%↑ has almost as much under management now but it’s all about the fees. The same is true on-chain and off-chain. ETFs are great, but they don’t help address Bitcoin’s fundamental utility issue.

Personally, I’m becoming increasingly more open to networks like Arbitrum ($ARB-USD) or Polygon ($MATIC-USD) as better Bitcoin scaling solutions than Lightning. Consider Wrapped Bitcoin ($WBTC-USD) which has 155k BTC spread out over the Ethereum ($ETH-USD) ecosystem:

It is faster and far cheaper to send WBTC over Polygon than to send BTC over Bitcoin. Could Bitcoiners ever come to grips with Ethereum scaling Bitcoin better than Bitcoin? If so, it leads to another inevitable question. If more users can be onboarded to a permissionless blockchain and transfer a tokenized version of BTC across borders, does it help Bitcoin’s Gold opportunity or does it actually help Bitcoin’s Gold threat?

Because if one takes the view that it’s okay to own BTC through custodians or centrally controlled EVM chains, why can’t tokenized Gold just be “digital gold” instead of BTC?

Disclaimer: I’m not an investment advisor. I share what I do and why I do it. I’m long BTC, LTC, ZEC, MATIC, ETH, XAG, and XAU. This post is not meant to illicit anger. It is merely an attempt at seeing these assets for what they are and what they can ultimately be.